Electronic Bank Realization Certificate (e-BRC) is an important document that establishes the details of inward forex remittance to avail various benefits under the Foreign Trade Policy and other tax exemptions and refunds under the GST provisions. It acts as a confirmation payment realized against exports made.

With an aim to make this process efficient and reduce compliance costs and burden for the exporters, the Directorate General of Foreign Trade has taken the initiative to allow generation of e-BRCs by exporters on a self-certification basis by visiting the DGFT website (www.dgft.gov.in).

eBRC is the digital proof (from your AD bank, via DGFT) that export payment was actually received. You generate it on the DGFT portal after your bank reports the inward remittance (IRM) to RBI’s EDPMS. eBRC data then powers compliance, incentives, and helps your bank close your shipping bills in EDPMS. Today, exporters can self-generate eBRCs on DGFT-no bank visits, no chasing branch counters-if the bank’s IRM has transferred to the DGFT.

What exactly is “eBRC closure”?

In day-to-day exporter language, people say “eBRC closure” to mean closing the loop on a export shipment after money is received:

-

Payment comes in → your AD bank files an IRM in RBI’s EDPMS (usually in 15 days).

-

You log in to DGFT and self-generate eBRC against that IRM and related shipping bill(s).

-

Bank closes the Shipping Bill in EDPMS (matching IRM ↔ SB), and your ICEGATE/EDPMS status turns green.

Opinion: treat eBRC as the “single source of truth” for realisation. If your ops team chases couriers, or buyer emails but doesn’t verify the IRM→eBRC→EDPMS chain, you’ll lose weeks and hefty penalties.

Why does eBRC matter?

-

Regulatory compliance: RBI requires export proceeds to be realised and closed within 9 months (goods from shipment date; services from invoice date; special timelines exist for warehouse sales). Banks follow up and close bills in EDPMS off that realisation.

-

DGFT / Customs workflows: eBRC data feeds multiple FTP/compliance processes; it’s the accepted digital proof of realisation across systems.

-

Banking & risk: pending EDPMS bills can affect credit and new negotiations; historically, exporters get caution-listed if bills remain open too long. (RBI discontinued automatic caution-listing in 2020, but persistent non-realisation still invites restrictions and follow-up.)

Official links for eBRC

-

DGFT – eBRC landing: dgft.gov.in/CP/?opt=eBRC

-

DGFT – Generate e-BRC: dgft.gov.in/CP/?opt=eBRCRules (rules/notes; e.g., one SB can map to multiple eBRCs; multiple IRMs can be added) (DGFT)

-

DGFT – eBRC User Guide (PDF): self-generation flow, login → Services → eBRC → Generate e-BRC. (DGFT Content)

-

DGFT – eBRC FAQs (PDF): confirms banks stop issuing eBRC once they are API-integrated; exporters download from DGFT after IRM. (DGFT Content)

-

ICEGATE – SB-EDPMS Enquiry Advisory: track/rectification pointers. (Icegate)

-

ICEGATE – SB Track (ICES): quick status check by SB no./date. (ICEGATE Enquiry)

-

RBI – baseline on realisation timeline (9 months) & earlier relaxations: official communication trail. (Reserve Bank of India)

-

2025 Draft RBI Directions/Updates (context): summaries consolidating the 9-month norm and warehouse timeline revision. (Policy still evolves-always check your AD bank’s latest circulars.)

When should I generate eBRC?

-

After your payment hits the bank and the bank has filed the IRM in EDPMS. You’ll see it reflect on DGFT eBRC screens; then you can self-generate eBRC and proceed. (If IRM isn’t visible, you can’t generate.) (DGFT Content)

The “9-month” clock and extensions

-

Default: Realise and repatriate in 9 months (goods: shipment date; services: invoice date). For goods in overseas warehouses, the timeline is tied to the date of sale under recent drafts (earlier it was 15 months from shipment). Your AD bank’s policy and the final RBI directions govern-so align with them.

-

Extensions: AD Category-I banks can grant extensions case-by-case under RBI rules/policies. Don’t assume-apply early and document reasons beyond your control.

Penalties & risks if you don’t close

Penalties for eBRC non-compliance can include the recovery of any duty drawback benefits claimed, as well as potential penalties imposed by the customs and DGFT authorities, though specific penalty amounts change time to time. Failure to realize export proceeds and submit the eBRC as required can result in customs taking action to recover benefits, and the DGFT may also take action, as eBRC is crucial for availing various benefits under the Foreign Trade Policy.

Potential Consequences of eBRC Non-Compliance

-

Recovery of Duty Drawback: If an exporter has claimed a duty drawback and fails to submit the eBRC, it will be presumed that export proceeds have not been realized, and customs will take necessary action to recover the drawback.

-

Customs and DGFT Actions: Customs can initiate recovery proceedings for benefits claimed against unfulfilled requirements. The DGFT may also impose penalties for non-compliance with eBRC procedures.

-

Invalidation of Benefits: The eBRC is used to avail various benefits, exemptions, and refunds under the Foreign Trade Policy and GST provisions. Failure to obtain a valid eBRC can lead to the denial or revocation of these benefits.

Step-by-step: How to self-generate an eBRC (fast)

-

Log in on DGFT → Services → eBRC → Generate e-BRC. (Make sure your IEC is linked.)

-

Pick the IRM(s) reported by your AD bank (EDPMS) or filter by date.

-

Map the shipping bill(s): one SB can feed multiple eBRCs; you can also combine multiple IRMs for a single eBRC, if that reflects how money came in.

-

Review and submit: download/print the eBRC.

-

Check EDPMS/ICEGATE status after the bank matches and closes the SB. Use ICEGATE’s SB-EDPMS enquiry/rectification advisory if there’s a mismatch.

Common blockers (and how to avoid them)

-

IRM missing on DGFT: Payment came, but the AD bank hasn’t pushed IRM yet. Check with the bank’s trade desk with UTR/SWIFT copy.

-

Mismatch in values/currency/charges: DGFT eBRC uses realisation value; freight/insurance/commission treatments differ. Keep your expense splits clean; DGFT takes the lower of FOB SB value vs eBRC realisation for certain calculations.

-

SB mapping issues: Remitter references don’t carry SB nos. Ensure buyers put SB#/Invoice#/IEC in SWIFT field 70/72 narrative to help the bank map quickly.

-

Warehouse exports: Timeline calculation changed in drafts (sale-date based). Align contract/OMS dates with AD bank expectations.

Save time with a 15-minute weekly ritual

-

Pull bank credits for the week; verify each has a UTR.

-

Check ICEGATE SB status for shipments dispatched in the last 12 weeks.

-

On DGFT eBRC, generate for any IRMs that have landed or filter by dates.

-

Escalate missing IRMs to the AD bank (attach SWIFT/UTR), always better to communicate via mail.

-

Keep a variance log (FOB vs realisation; FX charges; commission) for audit-proofing. Shipzy does this automatically.

My opinion: Indian exporter should use Shipzy export software to navigate complex process of documents and make compliance like eBRC automated.

Recent tweaks worth knowing

-

Self-generation of eBRC (exporter-side) is now standard.

-

Small-value SB closure: RBI guidance has trended towards easier closure for small values; implementations vary by bank-ask your AD for their current threshold/process.

-

Policy consolidation: RBI is consolidating export/import directions; the 9-month norm remains the anchor; warehouse timeline language has been refined in drafts. Track your AD bank circulars.

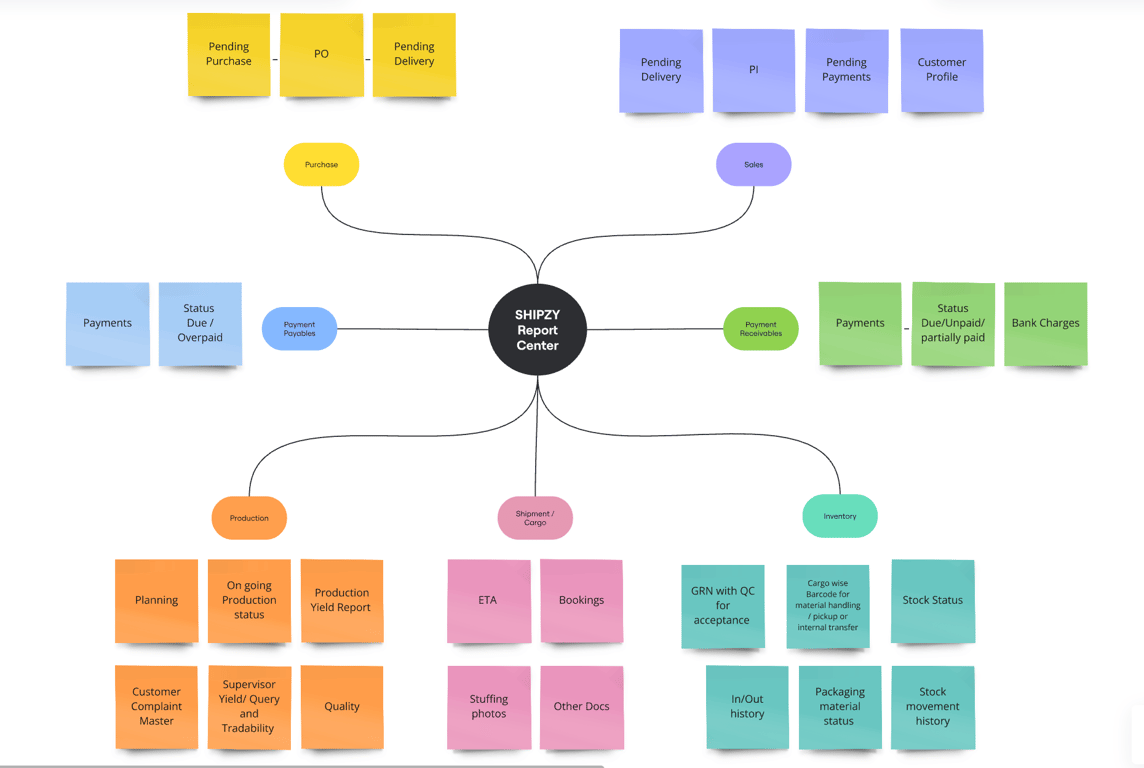

How Shipzy can automate eBRC closure (so your ops team doesn’t)

What Shipzy can do today (with your permissions & credentials):

-

Auto-create eBRC management list and match to invoices/SBs using rules (invoice no., buyer name, amount, currency, value date).

-

Watch for IRMs: maintain a reconciliation queue of paid-but-IRM-pending items and auto-generate banker nudges with UTRs.

-

Draft eBRCs on DGFT: pre-fill eBRC drafts for your team to click-through on the DGFT eBRC module.

-

ICEGATE tracker: poll SB status (where permissible) and flag SBs that should be closed but aren’t, with a one-click rectification note referencing the SB-EDPMS Enquiry advisory.

-

Exception playbooks: value mismatches, partial realisations, commission entries, currency spreads-Shipzy proposes the correct split and documentation to pass DGFT/Bank checks.

-

Dashboards for CXOs to check statuses and compliance work needs to be done by your team.

Quick FAQ

What if my payment came, but eBRC isn’t available in DGFT?

Likely the IRM isn’t filed or there’s a mapping mismatch by bank. Escalate to the bank with UTR/SWIFT; then use DGFT to generate eBRC.

What’s the current realisation timeline?

Baseline 9 months (goods from shipment; services from invoice). Drafts refine warehouse cases; always align with your AD bank’s latest circular.

What are the penalties for delays/non-realisation?

The eBRC is used to avail various benefits, exemptions, and refunds under the Foreign Trade Policy and GST provisions. Failure to obtain a valid eBRC can lead to the denial or revocation of these benefits.

Final checklist (copy/paste for your team)

-

Payment received & IRM captured in Shipzy.

-

IRM visible on DGFT eBRC screen (if not, ask bank)

-

eBRC list generated by Shipzy.

-

SB closed in EDPMS

-

Ageing watch: any item approaching 9 months gets priority follow-up or automate in Shipzy.